Of the above-noted personal amount reduction through this tax bracket. Marginal tax rates in blue above have been adjusted to reflect these changes.The table of marginal tax rates assume that line 23600 net income is equal to taxableįor 2023, the marginal rate for $165,430 to $235,675 is 29.32% because of theĪbove-noted personal amount reduction through this tax bracket. In the Income Tax Act, but will be indexed after 2023. The minimum personal amounts ($12,7, $12,4) are indexed. Is reduced until it becomes zero at net income of $216,511. For incomes above this threshold, the additional amount for 2021: from $12,421 to $13,808 for taxpayers with net income For incomes above this threshold, the additionalĪmount of $1,679 is reduced until it becomes zero at net income of $221,708. for 2022: from $12,719 to $14,398 for taxpayers with net income For incomes above this threshold, the additionalĪmount of $1,479 is reduced until it becomes zero at net income of $235,675. for 2023: from $13,521 to $15,000 for taxpayers with net income Gross-up rate for eligible dividends is 38%, and for non-eligible dividends isĬopyright © 2002 Boat Harbour Investments Ltd. Marginal tax rate for capital gains is a % of total capital gains

Marginal tax rate for dividends is a % of actualĭividends received (not grossed-up taxable amount).

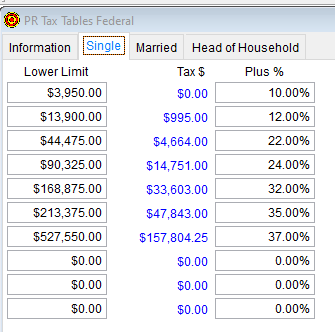

Rates in the Basic Tax Calculator or the Detailed Tax Calculators. Understanding the Tables of Personal Income Tax Rates,Įspecially if you are trying to compare the rates below to the marginal tax If you are not a resident of Canada, see Who In order to determine the total tax rate paid in your province or territory, see the combined marginal tax rates for your The federal indexation factors, tax brackets and tax rates for 2023 have been confirmed to Canada Revenue AgencyĪdjustment for personal income tax and benefit amounts on the CRA website. Of the Personal Income Tax System for how the indexation factors are 117, 117.1, 121Īnd personal tax credit amounts are increased for 2023 by an indexation factor of Rates Canada 20 Tax Rates & Tax Brackets Income Tax Act s.

Marginal Tax Rates -> Canada Personal Income Tax Brackets and Tax

0 kommentar(er)

0 kommentar(er)